At the beginning of August, before the current COVID-19 outbreak, I penned an article for this website, Rocky Times Ahead, which noted a rise in consumer prices and predictions of rising interest rates. I concluded that workers would have to be on their mettle to defend their living standards. Then came the COVID outbreak and I wondered whether the economic dislocation of lockdowns would dampen inflation and deter the Reserve Bank from increasing the base interest rate, known as the Official Cash Rate (OCR). However, now, in the latter half of October, we can confirm that prices and interest rates are on a rising trend.

The lockdown did have an effect. The Monetary Policy Committee of the Reserve Bank decided on 18 August to keep the OCR at 0.25 percent. The bank was explicit: ‘Today’s decision was made in the context of the Government’s imposition of Level 4 COVID restrictions on activity across New Zealand.’

Meeting again on the 6 October, the Monetary Policy Committee agreed to raise the OCR to 0.5 percent; still very low, but the first rate increase since July 2014. Retail banks immediately raised mortgage rates.

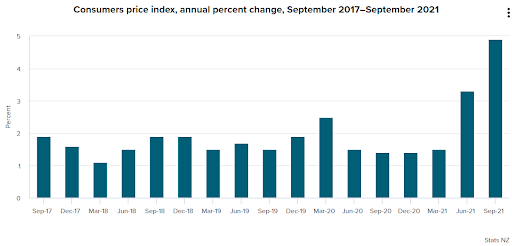

Prices have continued to climb. The latest figures are for the September 2021 quarter. CPI has risen by an annual rate of 4.9 percent. Prices are on a rising curve; by the end of the year expect the annual inflation rate to be well over 5 percent.

Price rises at this rate will hit working-class people in the pocket noticeably. The unavoidable basics of housing, transport and food are leading the way in the inflation rate overall. Price inflation is a huge threat to living standards; it begs the questions of whether pay rates will keep up with price inflation and what will workers do to defend themselves?

The picture on pay inflation is not a simple one. Statistics New Zealand’s headline pay increase for the year to June was 2.1 percent, according to the Labour Cost Index. However, the Quarterly Employment Survey reported a 4.0 percent increase in hourly earnings. A briefing paper for the New Zealand Parliament on the different measurements of pay states that ‘Stats NZ have recommended using the percentage change in all salary and wage rates (including overtime) from the adjusted LCI as the main indicator of wage increases.’ LCI ‘shows changes in wages earned per job rather than per individual.’ For these and other technical reasons the parliamentary briefing prefers the LCI as the recommended measure of wage growth.

If the LCI is preferred, the 2.1 percent increase in pay for the year to June lagged behind CPI which registered a 3.3 percent increase in prices. I expect that by the end of the year the gap between pay and price rises will be much greater. If we are entering a period of high inflation, it will be worth remembering that it originated with increases in prices, a global phenomenon, and was not caused by higher wage rates. Inevitably, when it comes to pay disputes, the capitalist media, the government and the employers will falsely argue that “greedy” workers are to blame for inflation.

The 2.1 percent average annual increase in pay to June can be broken down a little. In the private sector the increase was 2.2 percent; in the public sector it was 1.9 percent. As trade unionism is concentrated in the public sector, these numbers suggest that, generally speaking, trade union organisation was not behind the overall increase in pay. So what was behind the increase? A news release from Statistics NZ explains: “This quarter, a lot of firms reported trying to match market rates and retain staff in a tight labour market. This, combined with the rise in minimum wage in April, helped drive wage inflation this quarter.”

Although competition between the employers over recruitment and retention may continue, they will not pay a cent more than they need to, and will use inflation to reduce their pay bills relatively. In the months ahead, workers will be faced with the problem of how to keep their wages in step with consumer prices. Inflation puts workers on the defensive, at least initially, as all thoughts of real pay increases are abandoned in favour of just catching up with prices.

So far there has been no leadership from the Council of Trade Unions (CTU) on the growing problem of pay and prices, yet the whole situation screams for a united working-class response. If consumer prices continue to increase, as they seem set to do, workers will be driven by economic necessity to struggle for inflation-matching or, better still, inflation-busting pay rises. It is impossible to say how and when fights over pay will play out, but when they do, a socialist policy for the struggle would be for the maximum solidarity with workers in action and a whole of working class perspective.